Downtown Pittsburgh’s Residential Market Makes a Big Comeback

‘We are not just seeing a movement, but we are seeing a momentum,” says one realtor.

Downtown Pittsburgh’s residential market has rebounded since the pandemic and in many ways is outperforming expectations.

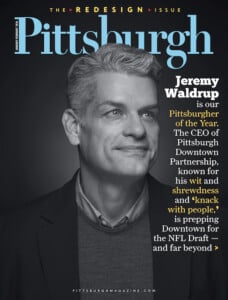

That’s the latest analysis by the nonprofit Pittsburgh Downtown Partnership, which is seeing rapid growth, especially by newcomers and those seeking new and luxury housing.

Nearly half of all Downtown residents — an average of 45% — lived somewhere else just one year ago, said Aaron Sukenik, PDP vice president of district development. Compare that to only 13% overall in Allegheny County.

“That means Downtown’s population is being driven by new residents,” he said.

Two age groups are leading the charge — 18-to-34-year-olds and those 65 and older.

“This reinforces Downtown’s role as a gateway neighborhood, attracting students, recent graduates and early-career professionals who are choosing to live close to work and all the sports venues, live music and performing arts venues — just an overall social lifestyle,” Sukenik said.

Older residents are showing the highest mobility — 57% of those were living someplace else a year ago (compared with 5% overall in the county).

“So from this, we can conclude that retirees and down-sizers are actively choosing Downtown, presumably also drawn by Downtown’s walkability and convenience,” he said.

Cate Irvin, PDP senior director of economic development, said Downtown’s residential occupancy has strongly rebounded since the pandemic. In 2019, before the pandemic, it had peaked at 94.8%. After dropping sharply to 81.6% during the height of the pandemic, it reached 93.8% during the third quarter of 2025.

“What’s notable now is that the Golden Triangle, our core, has led all neighborhoods and occupancy for the second consecutive quarter,” she added. It’s slightly higher than the North Shore (93.2%) and Strip District (91.4%).

New construction and conversions Downtown have a 95% occupancy rate and are demanding the highest rents of all housing in the Golden Triangle — on average of $2.63 per square foot, which is on par with residential rates in the Strip District, Irvin said.

She pointed to the Ivy Residences in the historic Triangle Building as “performing exceptionally well.” Located at 705 Smithfield St. in the Cultural District, it has leased all 15 luxury apartments, with monthly rents ranging from $1,970 for a one-bedroom unit to $8,500 for a four bedroom unit.

“Our key takeaway here is the Downtown housing market is strong, it’s stable and it’s competitive.”

Denise Bortolotti, a Realtor with Piatt Sotheby, specializes in Downtown luxury residential properties. “The luxury market is leading Downtown’s comeback,” she said.

“What’s exciting right now is we are not just seeing a movement, but we are seeing a momentum,” she said. “Downtown continues to be one of the most consistent and resilient markets in our region.”

She said even with some of the hurdles — higher interest rates, post–pandemic shift to suburban living, media narratives that don’t reflect what is actually happening — Downtown is holding very strong.

Bortolotti highlighted recent success with sales at The Maginn Lofts, a 7-unit building on Liberty Avenue that several years ago was converted to luxury units costing up to $1.4 million. “Until this year, none had ever sold.” She recently handled the sales of two of the units.

“So this kind of turnaround, especially on a street that still faces visible challenges like Liberty Avenue, it sends a powerful message that people are betting on Downtown again.”

There’s still a lot of work to do, she cautioned. “We need more everyday amenities, for example, things like a full-service grocery store and other neighborhood conveniences that make urban living effortless.”

Sukenik said there are another 1,100 units in 15 projects that are on track to be delivered within the next three years. They’re in various stages of planning and construction. He said that number does not include the conversion underway at the Gulf Tower, which would add 350 units and be available in 2030.

Barriers to conversion remain: Construction costs continue to rise, there are financing gaps in some projects and increased competition for capital. For some of this investment, Pittsburgh has to compete with other peer cities in Ohio (like Columbus and Cincinnati), which offer a larger state historic tax credit program and a robust mixed-use housing development tax credit program.

Overall, there is about 8 million square feet that can be converted from office to residential or other uses, he said. “Converting that square footage could bring our residential population from 7,300 to 15,000.”