Pittsburgh’s Downtown Office Vacancy Still High at More than 18%

Still most tenants are staying in the Golden Triangle and newcomers are moving in, according to the Pittsburgh Downtown Partnership.

When the architectural firm of LGA Partners was looking in 2022 to move out of Uptown in search of larger office space, it considered all options — the suburbs, fringe neighborhoods to Downtown Pittsburgh and Downtown itself.

It ultimately chose space at Four Gateway Center, the office complex near Downtown’s Point, for a host of reasons.

“One of the things about Downtown in 2022 was opportunity,” said Jonathan Glance, managing partner of the 30-year-old firm. Coming out of the pandemic after an exodus of office workers from the Golden Triangle, “rent was cheaper, and landlords were interested in doing deals.”

“It was a once-in-a-lifetime, once-in-a-generation opportunity. Downtown rates were never going to be cheaper than they were in 2022,” he said. “Now that we’ve been there for two years, we feel like that’s been an excellent payoff.”

Other advantages: its central location. “We have employees coming from four corners of Western Pennsylvania, so if you pick a suburb, you’re bound to make it very inconvenient to 70% of your workforce.” Because of the collaborative nature of architecture, it was essential that employees be in the office most days of the week. Employees come by bike, bus, carpool and car — all of which can be accommodated Downtown.

They also liked the views, natural light of the building design, the fact all of its employees could be on one floor for the collaboration, the integral parking and close vicinity to Market Square, shops and restaurants.

“We’re really happy with our decision,” he said. “We didn’t lose anybody [in the move]. We had great success with retention and attracting talent.”

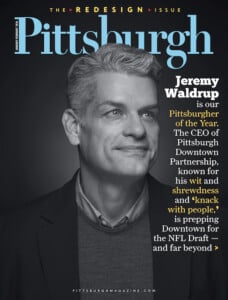

Glance told his story during the Downtown Pittsburgh Partnership’s Q3 State of Downtown update that focused on the health of the city’s commercial office market.

Like other cities across the country, Pittsburgh is struggling to fill its Downtown office space as it continues to rebound after the pandemic, which hit hard in 2020. The vacancy rate in the central business district (which extends slightly into Uptown and the Strip District) is 18.3%. The vacancy rate in the fringe neighborhoods of Downtown is 12.9% and overall in Pittsburgh, 11.9%.

In a PDP chart of Downtown vacancy rates stretching back to 2013, it hit its lowest point — about 7.8% — in 2015.

The PDP’s analysis shows that lease renewals and relocations within Downtown are happening at 60% to 70% of their previous square footage — meaning tenants are downsizing, said Aaron Sukenik, PDP vice president of district development. “So unless there are new, large anchor tenants coming into the market, 30% to 40% of office space could be vacant within the next decade.”

To reach a better balance of building use Downtown, Sukenik said, 35% of the office square footage — 8.2 million square feet — should be converted to non-office uses, such as residential or other uses. Many conversions already are underway.

With a current Downtown population of 7,000, the hope is to build that to at least 15,000 Downtown residents in the next decade, Sukenik said.

Two complexes — Oxford Centre, between Grant and Smithfield streets, and Fifth Avenue Place, have shown resilience and success by making investments in their buildings, bringing in new tenants, lease renewals, said Cate Irvin, PDP senior director of economic development.

Despite all of the upheaval, most Downtown tenants are remaining Downtown, she said. The main anchor tenants are legal offices and business services. “Business and legal services are vital to Downtown’s vibrancy,” she said.

The key question going forward is “whether the vacancy rate is beginning to level off or are further increases ahead,” Irvin said.

One big concern is the future of the BNY Tower on Grant Street, which will lose all of its tenants in coming years. “Obviously reusing a building is going to be much more cost effective than deconstruction,” said Jeremy Waldrup, president and CEO of the PDP. “And I think the question around deconstruction is likely, who would pay for that?” He said he has heard estimates that it would cost $8 million to $12 million to implode the building if other uses cannot be found.

Still, there are some bright spots. Another business that recently downsized but decided to stay Downtown was Meyer Unkovic Scott attorneys. They moved from another Downtown building to the U.S. Steel Building on Grant Street, going from 38,000 square feet to 32,000 square feet.

“This is a significant, long-term investment for Meyer Unkovic Scott, and not one that we took lightly,” said Christopher P. Smith, managing partner. “We really determined that the Downtown market was really the best place for us for a number of different factors.

“We’re excited both about where Downtown has been and where we think Downtown is going,” he said. “We recognize that evolution is taking place in front of our eyes, and we look at that as more of an opportunity as opposed to a negative.”