The Case for Owning More Stocks

Not owning enough stock can potentially jeopardize an older investor’s spending goals.

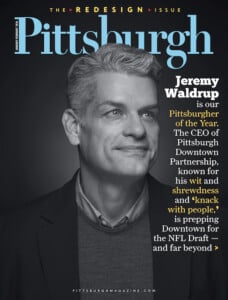

PHOTO VIA PIXABAY

There is a misconception that older investors should not own much stock in their investment portfolio. While stocks can be riskier than owning safer assets like bonds and cash, depending on the investor, not owning enough stock in their overall asset allocation can also potentially be a risky strategy.

It fails to consider the goals and risk tolerance of the client. Consider an older investor with a higher risk appetite, willing to endure greater market volatility for the potential of superior stock growth. Perhaps the client does not rely on her investments for living expenses, but instead intends to pass them along to younger children or grandchildren?

Additionally, not owning enough stock can potentially jeopardize an older investor’s spending goals by failing to help secure a growth rate that surpasses their expenditure rate. This concern is particularly pertinent for retirement, which often spans decades, not just years. The idea that one should completely exit the market upon nearing or entering retirement, safeguarding all assets in a ‘fireproof safe,’ is a fallacy.

While prudent asset allocation in a mix of stocks, bonds, and cash are important, many investors err on the side of not having enough stock exposure in their portfolio. When investors are too conservative, they may actually increase the risk to their long-term financial success. They fail to invest one of the asset classes capable of outpacing the combined pressures of taxes, inflation, and spending on the portfolio – stocks.

Spanos Group of Raymond James

Financial Advisors

1069 Third Street // Beaver, PA 15009 // 724.371.2001

spanosgroup@raymondjames.com // www.spanosgrp.com

Raymond James & Associates, Inc., Member New York Stock Exchange/SIPC

The opinions expressed are those of Spanos Group and not necessarily those of Raymond James & Associates and subject to change at any time. The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Every investor’s situation is unique, and you should consider your investment goals, risk tolerance and time horizon before making any investment. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including asset allocation and diversification. Keep in mind that there is no assurance that any strategy will ultimately be successful or profitable nor protect against a loss. Holding stocks for the long-term does not insure a profitable outcome. Investing in stocks always involves risk, including the possibility of losing one’s entire investment. Prior to making an investment decision, please consult with your financial advisor about your individual situation. Past performance does not guarantee future results.

Sponsored content is created and paid for by the marketer.